Executive Summary

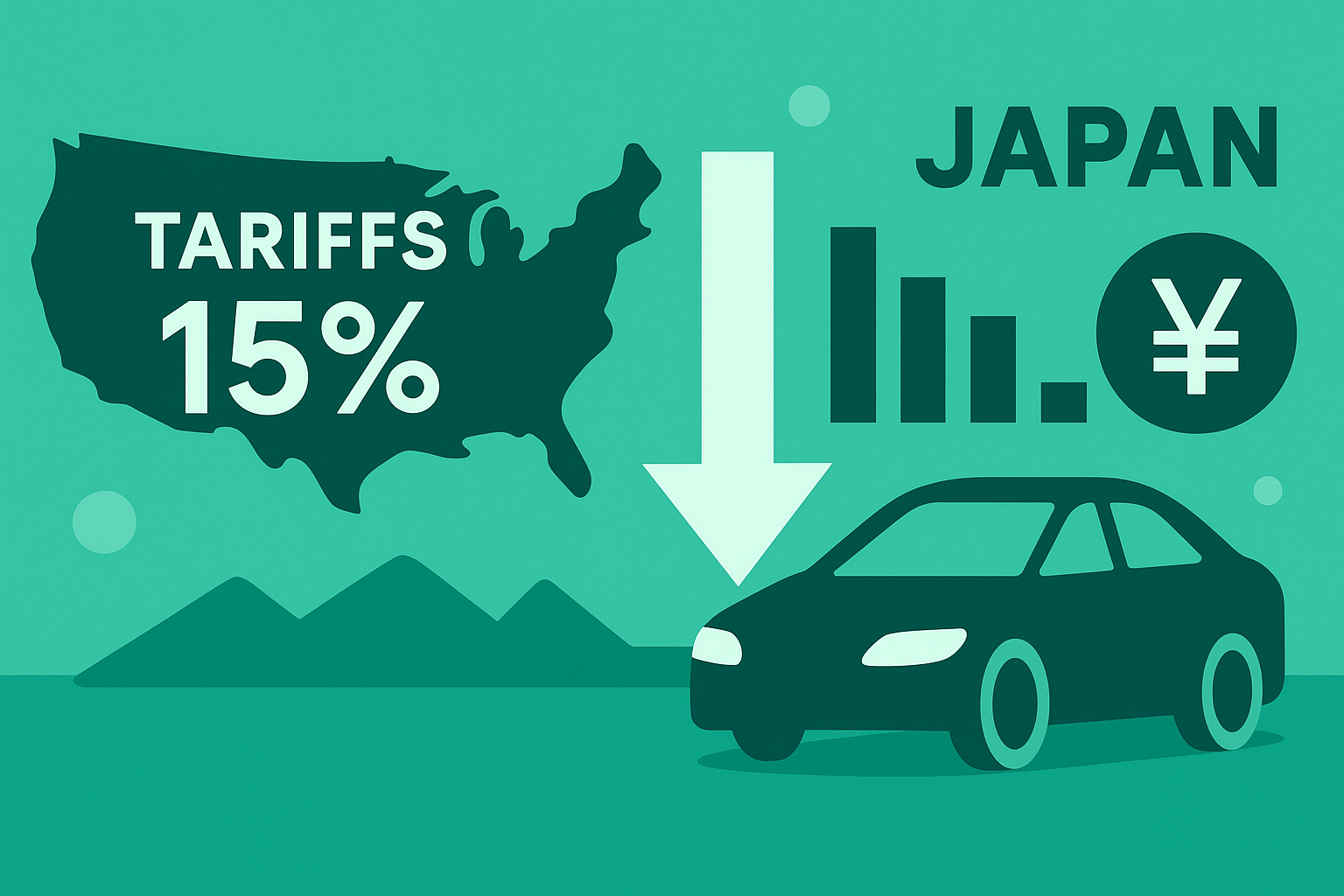

In July 2025, the U.S. and Japan agreed to lower auto tariffs from 27.5% to 15%. However, this remains significantly higher than the pre-Trump 2.5% level. August trade statistics already show a 13.8% decline in total exports to the U.S. and a 28.4% drop in auto exports, highlighting strong external headwinds.

Meanwhile, inflation stands at 2.7%, still above target, though easing due to lower fuel prices and a pause in yen depreciation. The Bank of Japan has kept its policy rate at 0.5% and is expected to hold steady for the remainder of the year.

Transmission Channels: How the Shock Spreads

1. Trade & Production

- Double Shock of Quantity and Price: If companies absorb tariffs, margins erode; if they pass them on, U.S. demand declines. Auto and semiconductor equipment shipments fell sharply in August.

- Supply Chain Spillovers: First- and second-tier suppliers in automotive parts, metals, and electronics are experiencing cost increases and order adjustments, slowing industrial production.

2. Corporate Behavior

- Shift to U.S. Localization: Automakers are investing in U.S. plants to avoid tariffs and strengthen political legitimacy. This, however, reallocates CAPEX away from Japan, softening domestic investment.

- Portfolio Adjustments: EV and high-end model launches in the U.S. are being revised, with some withdrawals or delays in product rollouts.

3. Prices & Monetary Policy

- Core CPI has slowed to 2.7%. The BOJ maintains a dovish stance, prioritizing financial stability over tightening.

Scenario Analysis (12-Month Outlook)

- Baseline (55%)

- Tariffs remain at 15%. Export drag persists but narrows, partly offset by EU and Asian demand. GDP growth trends around 0.5–1.0%, supported by domestic demand and public investment.

- Upside (25%)

- Expansion of tariff exemptions boosts auto shipments and business confidence. The BOJ could consider gradual rate hikes next year.

- Downside (20%)

- Tariff hikes or U.S. demand slowdown reignite export weakness, risking a temporary negative GDP growth phase with higher market volatility.

Sectoral Impact

- Automobiles & Parts: Margin squeeze and volume decline persist. Raising U.S. localization ratios and revising pricing strategies are urgent.

- Semiconductor Equipment: U.S. shipments weakening, diversification into EU and Asia is key.

- Materials (Metals, Chemicals): Export demand softens, though cheaper fuel costs provide a cushion.

- Logistics & Shipping: Route optimization toward Europe and the Middle East becomes critical for earnings.

Policy and Corporate Implications

Policy Priorities

- Trade: Push for expanded exemption lists and flexible rules of origin under NAFTA frameworks.

- Monetary: BOJ maintains current settings, closely monitoring tariff spillovers.

- Fiscal: Supplementary budgets should support capital investment tax breaks, SME financing, and employment adjustment subsidies.

Corporate Priorities

- Refined Pricing Models: Build granular demand elasticity frameworks by U.S. state and vehicle segment.

- Tariff Risk Accounting: Track and disclose “Tariff EBIT” by product category to guide resource allocation.

- Supply Chain Optimization: Reinforce a U.S.–Mexico production hub plus EU export diversification, adapting HS codes and parts sourcing to align with exemptions.

Key Monitoring Indicators

- Monthly export trends for autos and semiconductor equipment

- CPI and PPI deceleration, wage momentum sustainability

- BOJ policy board vote splits, fiscal stance under possible political shifts

Conclusion

The Trump tariff regime, even at 15%, imposes a triple challenge on Japan: weaker external demand, accelerated U.S. localization, and long-term risks of domestic industrial hollowing-out. Companies must act decisively through pricing precision, tariff-sensitive accounting, and supply chain re-engineering, while policymakers negotiate exemptions and reinforce domestic competitiveness.