Global Trade Reversal and Japan’s Strategic Response —

Date: July 18, 2025 Author: Senior Economist

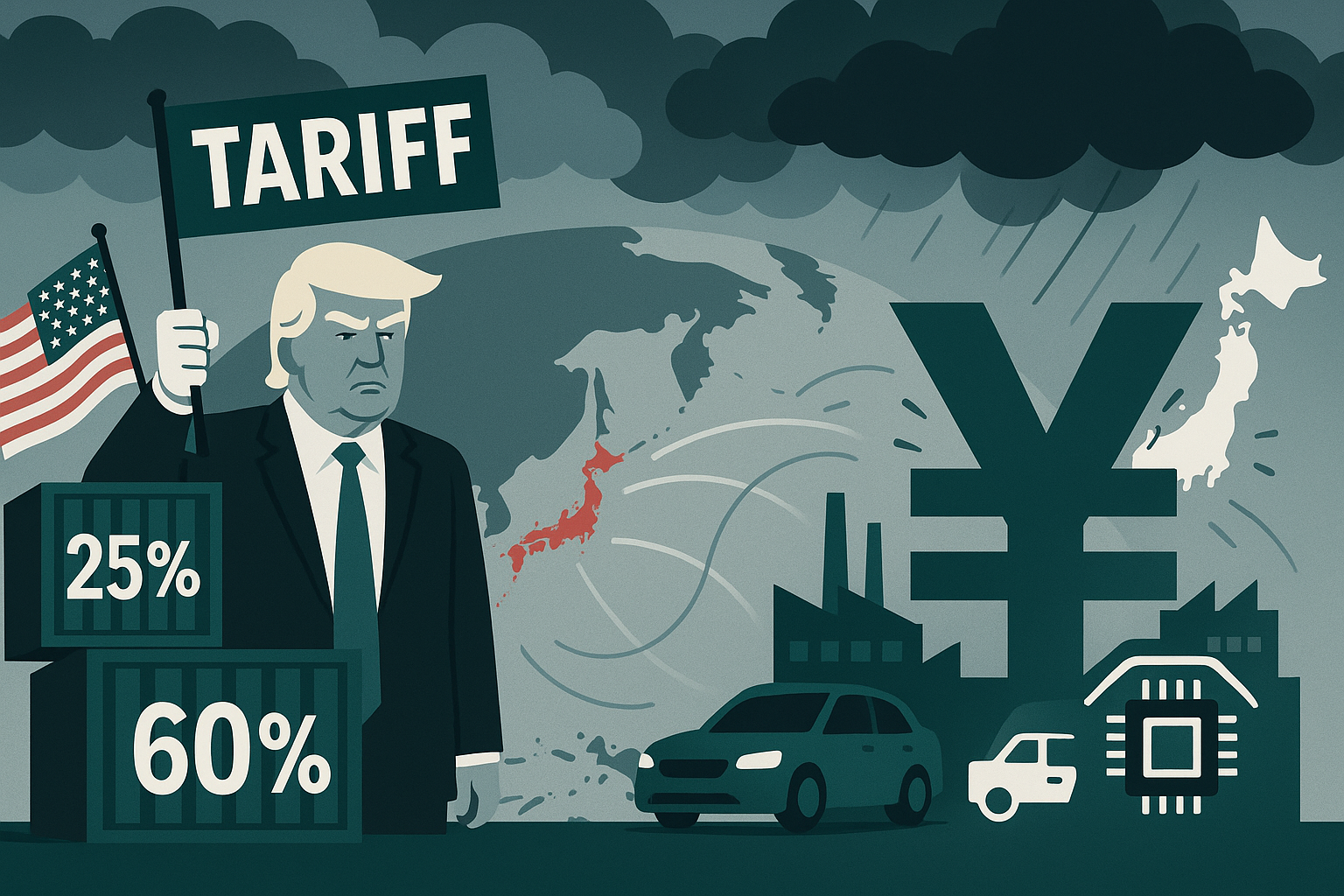

Overview: The Second Tariff Shock Begins

In 2025, President Donald Trump re-entered the White House and reinstated his “America First” trade policy. His administration has announced a sweeping new wave of tariffs targeting both strategic and politically symbolic industries.

Key highlights of the new tariff policy:

- Up to 60% tariffs on imports from China, Mexico, the EU, and Japan

- Specific targeting of autos, semiconductors, batteries, steel, and agriculture

- Possible re-designation of Japan as a currency manipulator, pressuring the yen

This marks not only a repeat of the 2018–2020 tariff cycle but a more aggressive decoupling from multilateral trade norms, creating profound risk for Japan’s export-oriented economy.

Sectoral Impact on Japan

🚗 Automotive Industry

- Exports of finished vehicles and auto parts to the U.S. exceed ¥5 trillion annually

- A tariff hike from 2.5% to 25% would undermine export margins and profit models

- Japanese automakers face renewed pressure to localize production in the U.S., despite cost challenges and FX volatility

💻 Electronics & Semiconductors

- Japan is deeply integrated into U.S.-China tech supply chains

- Equipment, sensors, and specialty materials will be affected by dual regulatory exposure

- Japanese firms risk collateral damage from both U.S. and Chinese retaliation

🌾 Agriculture & Fisheries

- Existing tariff reductions under the U.S.-Japan Trade Agreement are now under threat

- Japanese produce and seafood may lose competitiveness against subsidized U.S. goods

Macroeconomic Outlook

| Indicator | Expected Impact | Notes |

|---|---|---|

| Real GDP | −0.4% to −0.7% | Export shock and weakened capex |

| FX (Yen) | Downward pressure | Currency manipulation label risk |

| Stock Market | Volatility and sector-specific decline | Especially auto, precision, chemicals |

| Corporate Earnings | Negative outlook for manufacturers | Particularly export-heavy firms |

Scenario Forecasts

| Scenario | Description | Impact on Japan | Risk Level |

|---|---|---|---|

| 🟢 Limited Tariff Measures | Selective and negotiable tariffs | Moderate impact; manageable | Low |

| 🟠 Full Tariff + FX Tensions | Broad tariffs and yen pressure | Significant macro & political risk | Medium |

| 🔴 Escalating Trade War | Retaliatory cycle; WTO disruption | Structural threat to global trade | High |

Japan’s Strategic Response: Dual Approach

🔰 Defensive (Short-Term)

- Emergency tax support and liquidity facilities for heavily exposed sectors

- Energy subsidies and FX hedging support in case of a sharp yen depreciation

- Diversify export markets toward ASEAN, India, and the Middle East

🚀 Offensive (Mid to Long-Term)

- Shift to IP, brand-based, and service exports less sensitive to tariffs

- Promote domestic demand and sustainable green growth (GX)

- Recalibrate trade diplomacy: deepen ties with CPTPP, EU, and India

Conclusion: From External Shock to Strategic Inflection Point

Trump’s tariffs present a clear and present danger to Japan’s economy—particularly its legacy export model.

However, this also represents an opportunity to restructure Japan’s industrial and trade strategy:

By accelerating the transition to a resilient, diversified, and knowledge-based economy,

Japan can transform this geopolitical shock into a long-term catalyst for reform and competitiveness.