—An Economist’s Perspective—

Executive Summary

Dubai’s economic ascent followed a sequence: resource dependence → hub development → institutional innovation → cluster deepening. The city leveraged (1) geographic location as a trade and logistics hub, (2) free zones and targeted deregulation, (3) simultaneous development of network industries such as aviation, tourism, and finance, (4) macroeconomic stability through a USD peg and infrastructure-led growth, and (5) flexible visa and labor policies. This combination built a diversified, non-oil economy. Key indicators highlight this trajectory: Dubai welcomed 18.72 million international visitors in 2024, Jebel Ali Port handled 15.5 million TEU, and the DIFC hosted 6,920 firms at end-2024, a record high.

1. Mechanisms of Growth

1.1 From Geography to Network Power

- Maritime Hub: Jebel Ali Port, together with JAFZA free zone, became a logistics and re-export powerhouse. In 2024, Jebel Ali processed 15.5 million TEU, while parent DP World posted 88.3 million TEU globally (+8.3%).

- Air Connectivity: Dubai International Airport (DXB) expects 96 million passengers in 2025. Plans for Al Maktoum International Airport (DWC) target ultimate capacity of 260 million passengers annually, securing future connectivity.

1.2 Institutional Innovation: Free Zones and Legal Frameworks

- First Wave (Logistics): JAFZA (1985) pioneered a regime of 100% foreign ownership and profit repatriation.

- Second Wave (Digital/Media): Dubai Internet City (1999) and Media City fostered IT and creative clusters.

- Third Wave (Finance): DIFC (2004) imported common law courts and an independent regulator (DFSA). By 2024, it hosted 6,920 firms, generating AED 1.78 billion revenue (+37%), while DFSA regulated 902 firms.

1.3 Building Network Industries

- Tourism: 2024 international visitors hit 18.72 million (+9%), the highest on record. H1 2025 arrivals reached 9.88 million (+6%), driving retail, F&B, and events.

- Aviation: Aviation’s GDP contribution is tracked by Oxford Economics, underscoring systemic dependence on Emirates and Dubai Airports.

- Finance: DIFC’s ecosystem is expanding in wealth management, Islamic finance, and listings. DFSA supervised USD 25.3 billion in new listings in 2024.

1.4 Macroeconomic Stability: USD Peg and Tax Reforms

- USD Peg: The dirham has been effectively fixed at 3.6725 per USD since 1997, anchoring FX stability while aligning interest rates with the US Fed.

- Tax Base Diversification: Introduction of 5% VAT (2018), 9% corporate tax (2023/24), and selective excise taxes broadened revenues. Free zones maintain 0% on “qualifying income,” while the UAE adopted 15% DMTT to comply with global minimum tax rules.

1.5 Labor Force and Demographic Growth

- Visa and Ownership Liberalization: Golden Visa (10 years), expanded residency options, and universal 100% foreign ownership enabled talent retention. Dubai’s population surpassed 4 million in August 2025, sustaining consumer and labor demand.

2. Historical Milestones

- 1980s: Jebel Ali + JAFZA launched the free zone model.

- 1999–2004: Internet/Media City clusters; DIFC opened in 2004.

- 2009–2012: Dubai World debt crisis triggered reforms in fiscal discipline and real estate regulation.

- 2018–2023: VAT and corporate tax introduced; “D33” plan launched in 2023, aiming to double GDP by 2033.

- 2024–25: Tourism and finance hit record highs; DWC expansion sets stage for future growth.

3. Sectoral Opportunities and Challenges

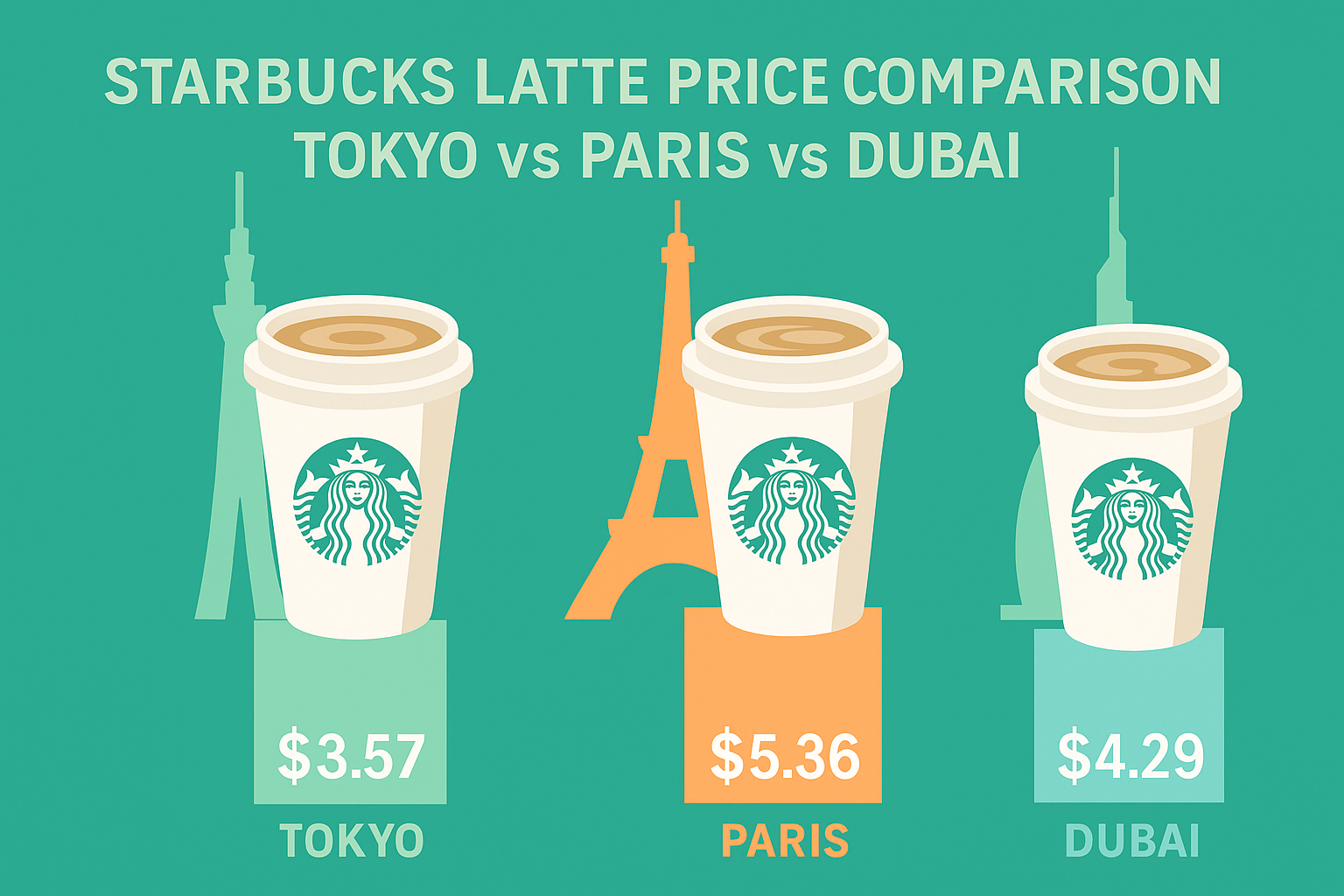

- Tourism & MICE: Record arrivals; risk of rising housing and living costs straining labor supply.

- Trade & Logistics: Strengthened by CEPA with India; sensitive to global interest rate cycles and geopolitical shocks.

- Finance: DIFC growth is robust, but regional competition (Riyadh, Doha, Abu Dhabi) is intensifying.

4. Macroeconomic Policy Implications

- Monetary Policy: The USD peg imports Fed policy, exposing Dubai’s real estate cycle to US rate shifts. Macroprudential tools (LTV, DTI caps) remain crucial stabilizers.

- Fiscal Diversification: Taxes now generate predictable revenues beyond oil. Excise taxes on sugary drinks (with graduated rates planned in 2025) mark further diversification.

5. Risks and Resilience

- Cyclical Vulnerability: The 2009 debt crisis showed dependence on external liquidity. Since then, regulatory frameworks improved.

- Urban Pressure: Rapid population growth strains housing, transport, and public services. Dubai 2040 Master Plan and D33 target green space, transport integration, and “20-minute city” models to address this.

6. Drivers for the Next Decade

- Capacity Expansion: DWC and Jebel Ali expansions align with global supply chain realignments.

- Regulatory Differentiation: Extending DIFC’s “imported legal ecosystem” to ESG finance, family wealth offices, and insurance.

- Tourism Upgrading: Moving from quantity to quality—medical, sports, cultural, and MICE tourism.

- Macroprudence under USD Peg: Strengthening financial stability tools to offset imported Fed cycles.

- Trade Diplomacy: CEPA agreements (e.g., India) enhance Dubai’s re-export and light manufacturing role.

Conclusion

Dubai’s growth model is built on hub development, institutional innovation, and simultaneous cluster building, anchored by a USD peg and investor-friendly free zones. Current records in tourism, finance, and logistics confirm resilience, while the D33 strategy sets the target of doubling GDP by 2033. Yet challenges—living costs, infrastructure pressure, imported US rate cycles, and regional competition—will determine whether Dubai sustains its trajectory over the next decade.