Japan’s Policy Rate Hike to 0.75%

- 1. Executive Summary

- 2. Financial System Stress: “Silent Credit Tightening” via JGB Valuation Losses

- 3. Real Economy Stress: Refinancing Risk and Corporate Shakeout

- 4. Fiscal and JGB Market Stress: Debt Sustainability at a Higher Rate Regime

- 5. FX and Global Financial Stress: Yen Carry Trade Unwind

- 6. Integrated Stress Scenario: The Key Tail Risk

- 7. Conclusion: Policy and Risk Management Implications

1. Executive Summary

Japan’s increase of the policy rate to 0.75% represents a structural break rather than a conventional tightening cycle. While the absolute level of interest rates remains low by international standards, the key risk lies in the abrupt transition away from a decades-long ultra-low interest rate regime.

This report analyzes stress transmission through four primary channels:

- the financial system,

- the real economy,

- public finances and the government bond market, and

- foreign exchange and global capital flows.

The most severe risk emerges not from any single channel, but from a compound scenario combining domestic credit tightening, yen appreciation, and deterioration in overseas cash flows, with direct implications for cross-border financing and long-term infrastructure projects.

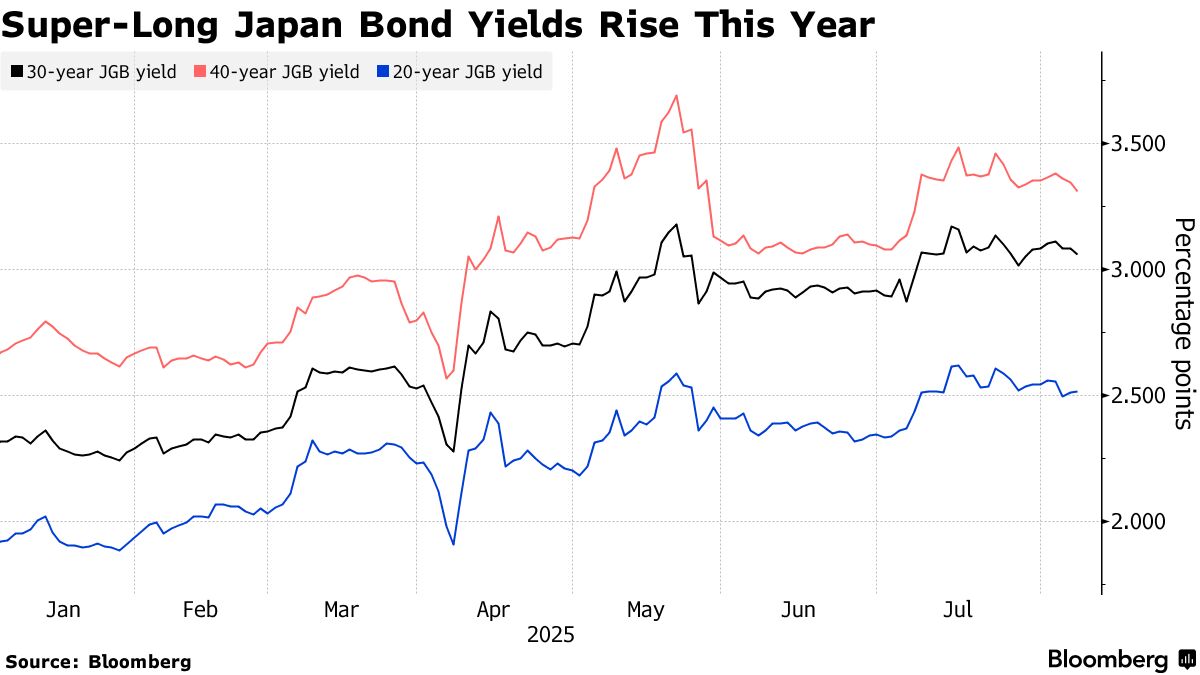

2. Financial System Stress: “Silent Credit Tightening” via JGB Valuation Losses

2.1 Transmission Mechanism

A policy rate hike places upward pressure on long-term yields, leading to valuation losses on Japanese Government Bonds (JGBs). Banks and life insurers—particularly regional banks—hold substantial volumes of long-duration JGBs as core assets.

While these losses may not immediately crystallize into solvency concerns, they weaken capital buffers and reduce risk-taking capacity.

2.2 Stress Scenario

- Gradual tightening of lending standards

- Reduced credit availability for SMEs and regional borrowers

- A widening growth gap between metropolitan and regional economies

2.3 Assessment

Unlike abrupt banking crises seen elsewhere, Japan faces a low-visibility but persistent form of financial stress, where credit contraction occurs without overt institutional failures.

3. Real Economy Stress: Refinancing Risk and Corporate Shakeout

3.1 Corporate Balance Sheet Impact

After years of ultra-low rates, many firms—particularly so-called “zombie companies”—are vulnerable to rising interest expenses. Stress materializes through:

- Higher servicing costs on floating-rate loans

- More restrictive refinancing conditions for corporate bonds and syndicated loans

- Margin compression for low-productivity firms

3.2 Stress Scenario

- Gradual increase in bankruptcies

- Sector-specific employment adjustments

- Disproportionate impact on real estate, construction, logistics, and SMEs

3.3 Assessment

While corporate restructuring may improve long-term productivity, short-term downside risks to growth and employment are non-negligible.

4. Fiscal and JGB Market Stress: Debt Sustainability at a Higher Rate Regime

4.1 Fiscal Sensitivity

With public debt exceeding 260% of GDP, even modest rate increases significantly raise debt servicing costs. This narrows fiscal space and increases market sensitivity to policy coordination.

Markets remain implicitly focused on the extent to which Bank of Japan is willing—and able—to stabilize the JGB market.

4.2 Stress Scenario

- Reduced stability in JGB auctions

- Higher term premia driven by fiscal concerns

- Renewed debate over tax increases or expenditure restraint

4.3 Assessment

The credibility of Japan’s fiscal–monetary policy framework becomes increasingly central to market confidence.

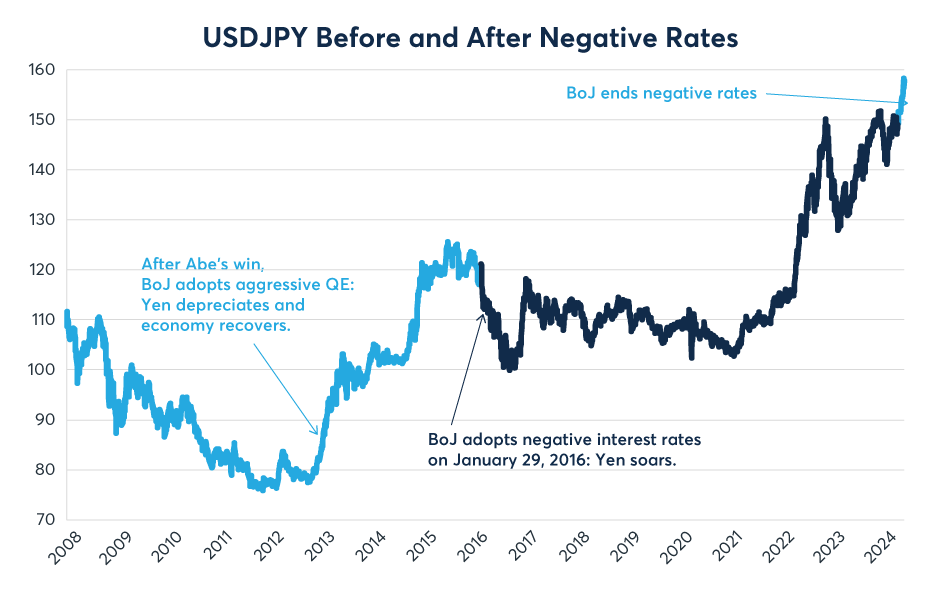

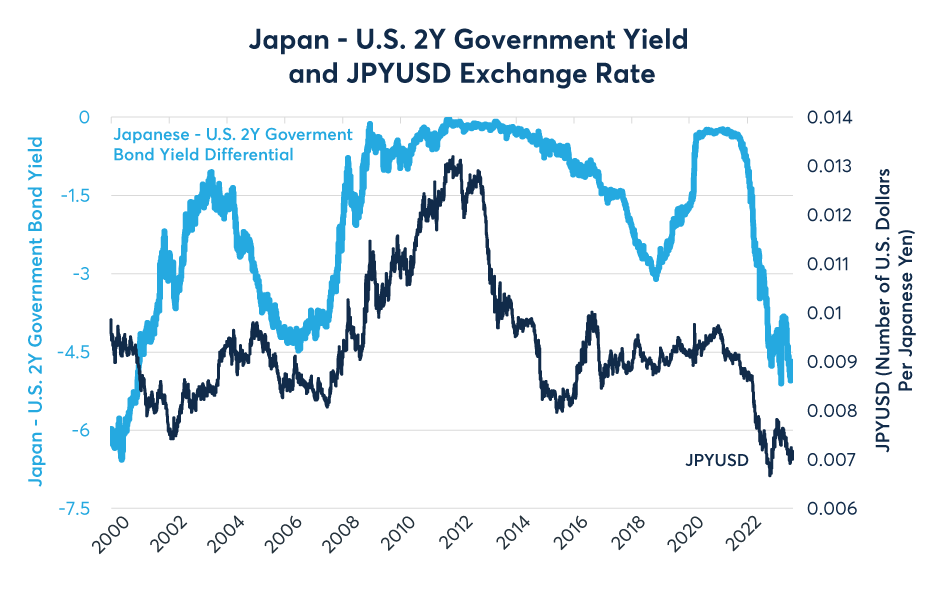

5. FX and Global Financial Stress: Yen Carry Trade Unwind

5.1 Exchange Rate Channel

A narrowing interest rate differential between Japan and the U.S. increases the probability of yen carry trade unwinds, leading to:

- Yen appreciation

- Pressure on exporters’ earnings

- Heightened volatility in Japanese and global equity markets

5.2 Global Spillovers

- Capital outflows from emerging markets

- Increased volatility in FX and bond markets

- Tighter global financial conditions

6. Integrated Stress Scenario: The Key Tail Risk

Most Concerning Risk Chain

Higher rates

→ Domestic credit tightening

→ Yen appreciation

→ Decline in exporters’ and overseas subsidiaries’ cash flows

→ Weakened debt service capacity in cross-border and project finance

Implications for JBIC and IFIs

- Deterioration in DSCR for long-term, low-margin projects

- Currency mismatches between yen funding and local-currency revenues

- Simultaneous rise in country risk and financial risk

7. Conclusion: Policy and Risk Management Implications

- Japan’s primary vulnerability lies in the speed of adjustment, not the level of interest rates

- Financial and real-sector resilience has not yet fully adapted to a positive-rate environment

- Careful sequencing of monetary normalization, fiscal strategy, and growth policy is essential

From a risk management perspective, forward-looking stress testing, scenario-based portfolio reviews, and heightened monitoring of tail risks are critical as Japan transitions into a new monetary regime.